3 To 2 Payout Calculator

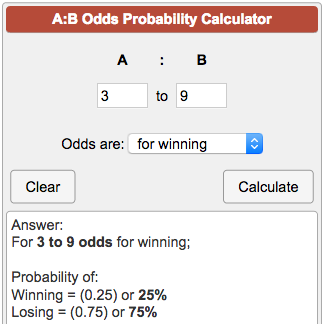

How to calculate a pay raise on your own. The formula the pay raise calculator uses is: new salary = old salary + old salary. raise% If you know the raise percentage and want to determine the new salary amount: Convert the percentage into decimal form. Multiply the old salary by this value. Add this new value to the old salary. To figure the cost of the Pick Three, multiply the number of horses in the first leg, times the number of horses in the second leg, times the number of horses in the third leg. For example, a Pick Three Part Wheel 2 with 4,6,9 with 1,2,7,8,10 = (1 horse x 3 horses x 5 horses) = 15 possible combinations or $15 based on a $1 Pick Three.

- 3 To 2 Payout Calculator

- 3 To 2 Payout Calculator Bankrate

- Retirement Payout Calculator

- Investment Payout Calculator

How does this payout annuity calculator work?

This comprehensive finance tool allows 3 types of annuity calculations, by taking account of the annual rate of return which is a mandatory info, the withdrawals frequency and of one of the combinations of 2 out of the other 3 fields as explained below:

3 To 2 Payout Calculator

Example - Man City have gone 2 goals up and the bookmaker has paid out into your £150 winnings. Now enter the current exchange BACK odds on Man City. If this is 1.2, then enter 1.2. The calculator tells us that we should place a £210.33 back stake. Game 1 and Game 3 will be calculated the same way, where we divide 100 by each moneyline odd and add 1. Game 2 will be calculated by dividing the moneyline odd by 100 and adding 1. The calculations are shown below: Next, we simply multiply our wager, which in this case is $50, by all three of those decimal odds. How does this payout annuity calculator work? This comprehensive finance tool allows 3 types of annuity calculations, by taking account of the annual rate of return which is a mandatory info, the withdrawals frequency and of one of the combinations of 2 out of the other 3 fields as explained below.

- First is forecasting the approximate annuity payout length in years. In this case you have to provide some values you expect for a Desired withdrawal amount and for the Starting amount / principal you assume you will have at the end in your annuity account.

- Second is estimating the savings end balance or the so called starting principal you should prepare for retirement by taking account of a Desired withdrawal amount during benefits time and a desired Annuity payout length in years.

- Third is the estimation of the withdrawal amount you may expect to receive if you specify a value within “Starting amount / principal” how much you expect you will have saved until retirement and how much do you expect to receive revenue within the field “Annuity length in years”.

This is a very flexible application since it allows any user choose between different withdrawals frequencies such as: monthly, bi-monthly, quarterly, semiannually or annually.

Its algorithm is based on the standard compound interest rules and on annuity formulas:

- solve for n – number of periods;

- solve for the annuity payout;

- solve for the principal required.

Example of 3 results

- Calculation of the payout length in years:

In case of a plan that assumes an available principal amount of $200,000, with a return rate of 5% and a desired withdrawal amount of $1,500 expected month by month, the results displayed are:

■ The estimated length in years of the annuity is 16.06 years.

3 To 2 Payout Calculator Bankrate

■ Withdrawals of $1,500.00 will take place Monthly.

■ Total interest earned during payout phase is $89,071.04.

- Forecast of the regular withdrawal amount:

If we look at an example that assumes a principal amount available of $300,000, with a return rate of 3.5% and a desired term to be paid out of 25 years with an annual withdrawal frequency, the results returned are:

■ The estimated withdrawal amount you will be able to receive with Annually frequency is $18,202.21.

■ Total interest earned during payout phase is $155,055.27.

- Estimation of the principal amount at the end of the accumulation phase:

/ToteBoard-58a340325f9b58819cf296f2.jpg)

For instance in case of someone who wants to know how much should save in account before retirement, if during benefits scheme the return rate would be 3.5%, the desired regular revenue would be $20,000 paid anually for a term of 25 years, the calculations will look as detailed within this table:

■ The estimated principal amount you should have already saved in account before starting payout is 329,630.29.

■ Withdrawals of $20,000.00 will take place Annually.

■ Total interest earned during payout phase is $170,369.71.

What is an annuity?

In finance theory annuity defines a set of regular payments made over a certain time period with the scope to achieve a specific money amount in an account either if is a regular or a retirement account or any similar; or with the scope to pay off a certain debt amount, for instance in case of mortgages paid on a monthly basis.

In United States this term is used to mean a financial product by which an individual lets an insurance company manage personal funds invested by case through a onetime payment plus some regular annual or monthly adds, or only by regular contributions with the final scope that the insurer will provide you with regular revenue starting the moment you specify. This kind of contract usually comprises several aspects such as:

The funds you have to deposit, invest and add on a regular basis during the accumulation period. It may be a onetime payment and/or regular contributions.

The accumulation term of the contract while you have to save;

By case a fixed return rate for your investment.

The fixed annuity quote often expressed as a percent that indicates the value of the withdrawal amount.

The withdrawals frequency meaning how often you will receive revenue within a year.

The age or the moment when you expect to receive revenue from the insurer.

As it can be easily observed from its terms and conditions, such product has two phases:

The accumulation phase refers to the number of years in which the client has to deposit funds into account. The insurance company will invest and reinvest this money in different yield financial instruments with the scope to multiply them.

The payout phase defines the term in which the client gets paid on a regular basis by the insurer.

For both parts this annuity calculator can help is simulating all assumptions on any of the 3 main sides of preparing for retirement: term and fixed revenue to be paid and savings level.

Retirement Payout Calculator

Types of annuities

People are acquiring such financial products at different times and for that must have some cash resources. Considering this aspect there are:

- Immediate annuity which refers to purchasing such financial product with a lump sum and then the client starts receiving revenue. This product type is preferred by people with a good financial standing that before retirement make this choice.

- Deferred annuity which is a contract by which the client has to make regular payments over a certain period of time. This strategy is preferred by people that acknowledge the need to put aside money well before retirement. Usually the payments are made either on an annually or monthly basis.

Going About the Payout

The most important thing about horse racing betting is the payouts, for at the end of the day its not enough to pick the right horse, but also wager on the right horse, meaning that a punter realizes when a horse is short priced or shows a decent price as a favorite and places a wager on that horse in order to collect bigger payouts. Many punters use a horse racing payout calculator so that they can keep good track of their stakes and possible payouts. This use of a horse betting calculator has improved the way punters approach horse racing betting.

Horse Racing Payout Calculator

Since nowadays many punters wager on more than horse and more than one race, the need for a calculation process that would concentrate all the wager and output the costs and payout figures has risen dramatically and created the need for a horse racing calculator to that just that and calculate the payout. The horse racing payout calculator comes in various ways depending on the wager type placed on the horse or horses. In the case of straight wagers, the horse racing payout calculator simply takes the odds, presented in decimal or fraction, and uses it together with the stakes laid on the wager to calculate the payout. This horse racing payout calculator usually holds a fraction converter for converting odds. Another type of horse racing payout calculator is the exotic wager horse racing payout calculator. This one is a bit tricky since the exotic payouts such as Trifecta or Superfecta derive from a separate wagering pool so there isn’t a way to know or calculate the payout until the payout is due to happen once the races are over. However, an estimation on the pool sum can be made by the horse racing payout calculator in order to give the punter a slight clue on the payout.

Investment Payout Calculator

Calculate Onwards

There is one approach in horse racing betting that has benefited from the development of today’s horse racing payout calculator and it’s referred to as let it ride. Let it ride means keep rolling the winning money onto other horse wagers in an attempt to strengthen the bankroll. This approach is very difficult to handle if not using a proper horse racing payout calculator. The horse racing payout calculator aids the punter with making decision by simplifying and clarifying all the possible scenarios in the let it ride scheme. The use of the horse racing payout calculator has contributed significantly to the variety of wager placing and different wager approaches by automating the calculation process thus making life a lot easier for the punters.